UNIVERSAL KNOWLEDGE HUB

Different Types of Taxes:

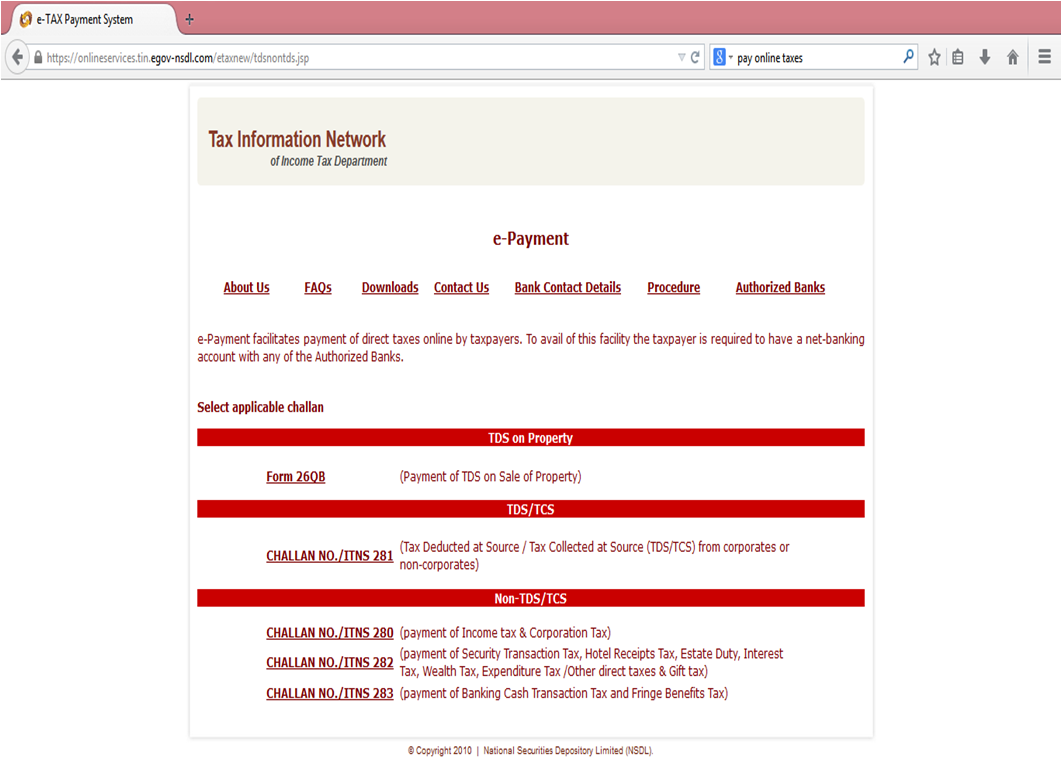

Step 1: Go to website to pay taxes, follow this link Pay Online Taxes

Different Types of Taxes:

Before, we know how to

pay taxes; we must know first what are the different types of taxes under

Income Tax Provisions

Taxes include interest

and penalty also, but we will discuss about taxes paid by the assesse or taxes

deducted from the income of the assesse alone.

There are popularly

three types of taxes we have:

·

Tax

Deducted at Source:

When the person responsible to pay any income to the any other person, and when

the person who is responsible to pay the income, pays the income after

deducting the tax thereon, such tax deducted will be known as Tax Deducted at

source. In this, the person who is paying the income is liable to deduct TDS,

and if doesn’t deduct TDS he will be liable for non deduction of TDS. The

person from whose income the TDS is to be deducted is in no situation can be

held responsible for the non deduction of TDS liability.

·

Advance

Tax:

If the tax payable by the person for the financial year exceeds Rs 10000 he is

liable to pay his tax liability to pay Advance Tax.

·

Self

Assessment Tax:

Self Assessment tax means any balance tax paid by the assessee on the assessed

income after taking into account the TDS and Advance tax before filing the

Return of income.

What is Advance Tax?

Section 207: Advance

Payment of Tax

Advance Tax shall be

payable in accordance with the provisions, only if the provisions are

applicable to the assesse.

Advance Tax provisions

are not applicable to the following:

·

A

person (Indian Resident Only) does not any income chargeable under the head

“Profits and gains of business or profession” and who attains the age of 60 years or more anytime during the financial

year

·

Provisions

of Advance Tax are not applicable to the assesse covered under Eligible

business (Assesse covered engaged in the business and declares their income as

per Section 44AD)

Section 208:

Conditions of liability of Advance Tax

Advance Tax shall be payable

during the year where the amount of tax payable during the year is Rs 10000 or

more

Section 209:

Computation of Advance Tax

Tax shall be

calculated in the following manner:

Particular

|

Amount

|

Tax on

Total Income

|

XXX

|

Add: Surcharge

and Cess

|

XXX

|

Total

Tax

|

XXX

|

Less:

TDS deducted

|

XXX

|

Amount

of Advance Tax

|

XXX

|

Section 211: Instalments

of Advance Tax and due dates:

Due date of Instalments in the

relevant Assessment Year

|

Amount payable by Corporate

Assesse

|

Amount payable by Non-

Corporate Assesse

|

On or

before June15

|

15 %

Advance Tax Payable

|

----

|

On or

before September 15

|

45 %

Advance Tax Payable

|

30 %

Advance Tax Payable

|

On or

before December 15

|

75 %

Advance Tax Payable

|

60 %

Advance Tax Payable

|

On or before

March 15

|

100 %

Advance Tax Payable

|

100 %

Advance Tax Payable

|

Other Points:

Any amount paid by way

of advance tax on or before 31st March of the relevant previous year

shall also be treated as Advance Tax paid during the financial year ending on

that day. But, interest u/s 234C applicable (Section 219)

Self

Assessment Tax: Section 140 A

Calculation of Self

Assessment Tax

Particular

|

Amount

|

Tax on

Total Income

|

XXX

|

Add:

Surcharge and Cess

|

XXX

|

Total

Tax

|

XXX

|

Less:

Relief and Rebate

|

XXX

|

Less:

TDS deducted

|

XXX

|

Less:

Advance Tax Paid

|

XXX

|

Amount

of Self Assessment Tax

|

XXX

|

Assesse himself is

liable to pay self assessment tax to the credit of Central Government. So in

case of any failure to do so, he will be liable for interest and penalties.

How to pay tax:

There are two methods

to pay:

E payment of taxes

(Payment of taxes online)

Other Methods (Generally

include offline method of Payment of taxes)

As per Notification No

34/2008 dated 13.03.2008, Following categories of assesses are mandatorily required

to make e payment of tax:

·

Corporate

Assesses

·

Non

Corporate Assesses subject to Tax audit

Mode of Payment

·

Internet

Banking Facility

·

Credit

Card or Debit Card (State Bank of India)

As per Circular 5/2008

dated 14.07.2008

An assesses can make E

payment of taxes also from the account of other person. The challan must

indicate the PAN of the assesses for whom payment is made.

How

to pay Online Tax:

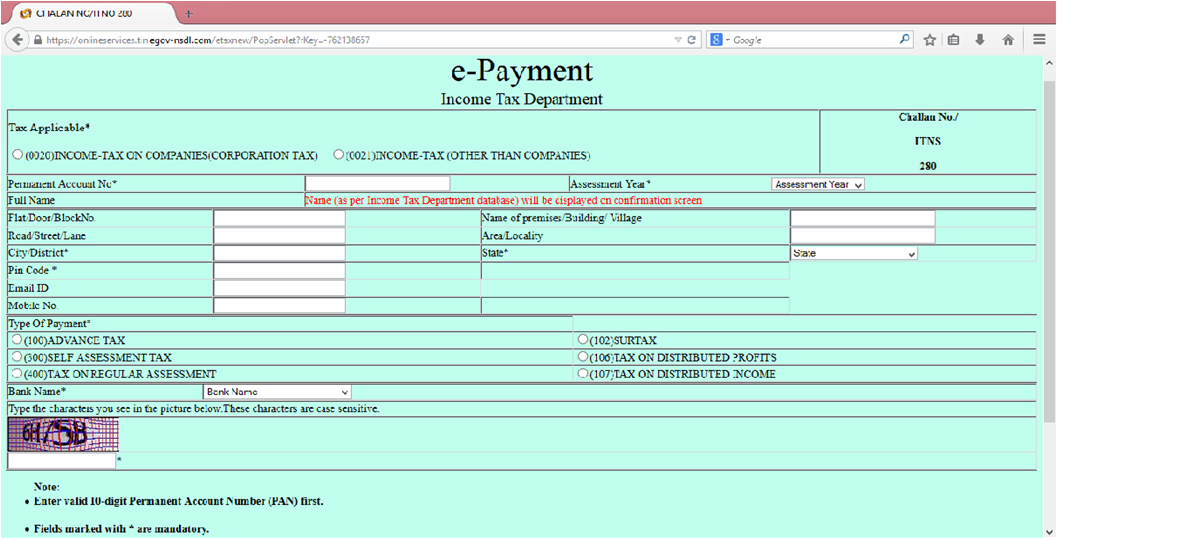

Step 1: Go to website to pay taxes, follow this link Pay Online Taxes

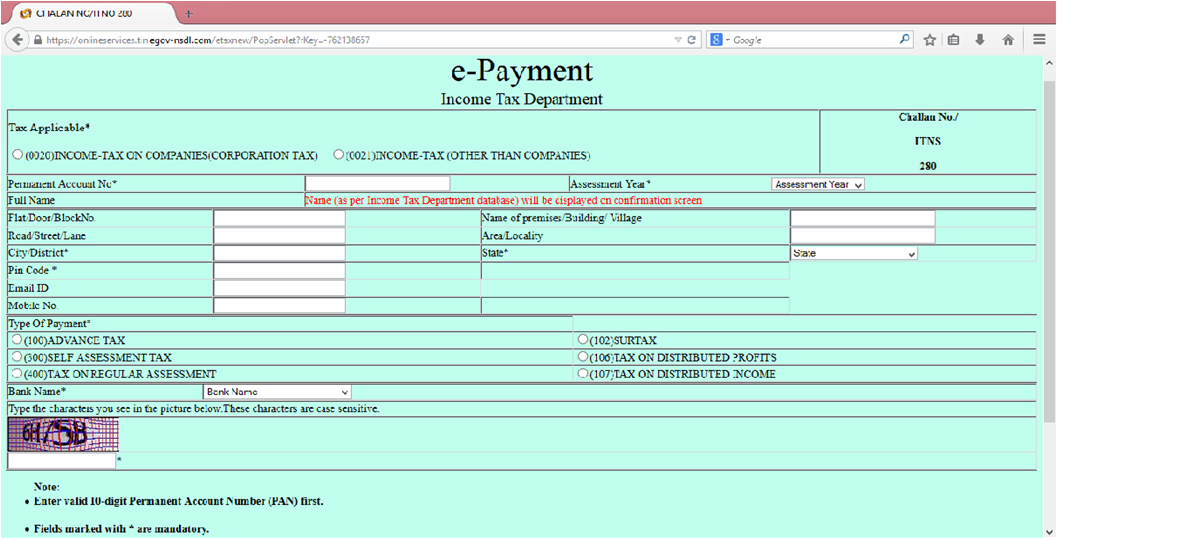

Step 2: Click on

Challan No 280

Step 3: Seclect Tax Applicable : Income tax on companies for companies or other than companies for others. Fill required

details in the Sheet, PAN, Address, Advance Tax or Self Assessment Tax, then fill

the bank name and special character. Then click proceed.

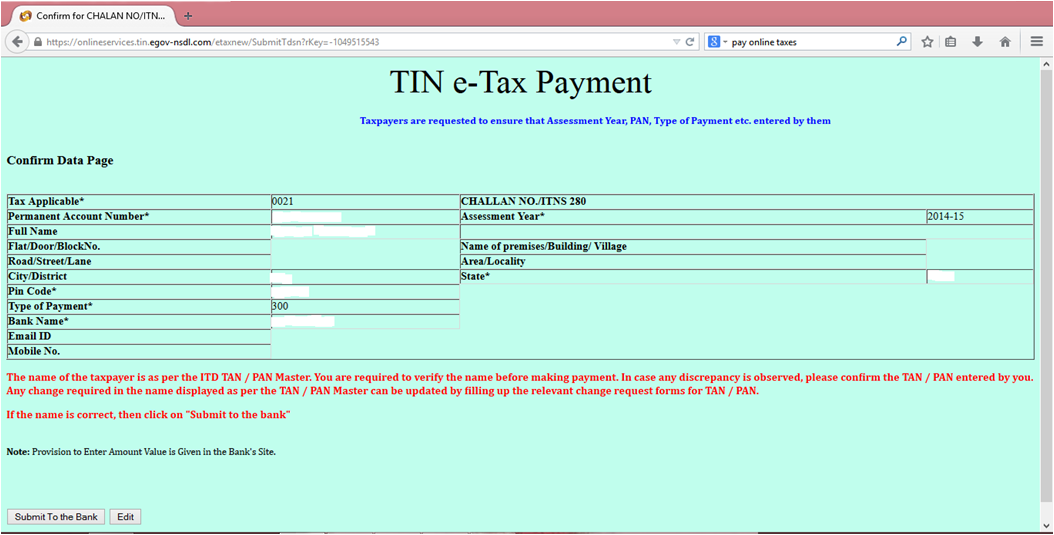

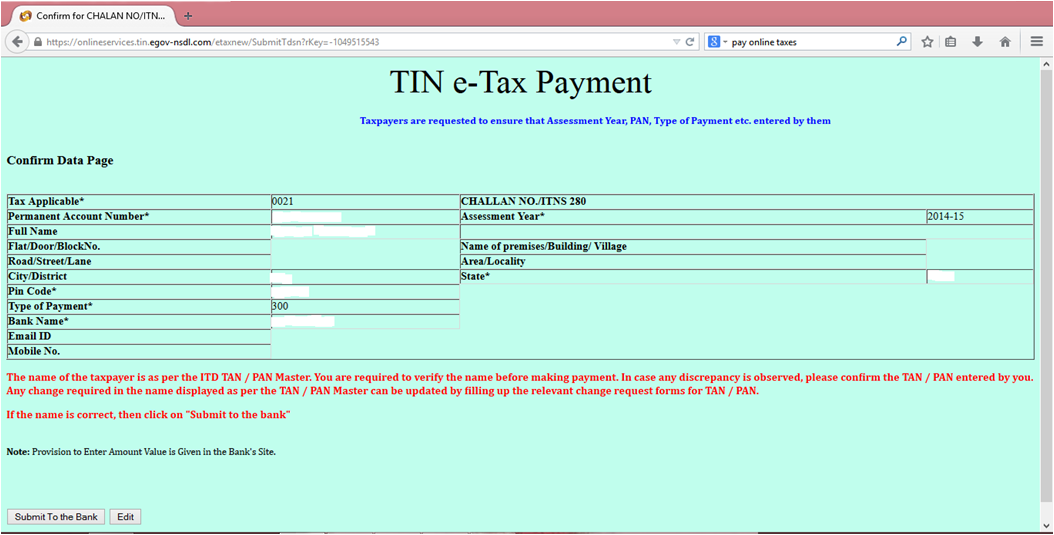

Step 4: A page will

open, then read the information, if finds it correct, the click submit to the

bank

Step 5: A new sheet

will open demanding user id and password, make log in and pay taxes

Step 6: After paying

online receipt will generate, which shows the date, amount, and time of payment

of tax along with Challan No.

Step 7: Use Challan

No, BSR Code and Date in all future correspondence

How

to pay Tax Offline

Step 1: Take Challan

NO 280, it is available on internet the file can be download from the link Download Challan 280

Step 2: Fill the

challan details

Step 3: Submit the

challan to the banker along with amount

Step 4: Banker will

take amount, and mention the date, challan no, and BSR Code on the challan copy

and return the page belong to assesse

Step 5: Use Challan

No, BSR Code and Date in all future correspondence

0 comments